NOT A DELUSION STEMMING FROM ILLIBERALISM

Calm down pseudo-liberals, who are in for European absorption. This note on the ‘deluded integrators’ is not penned to bring to light about Russians entering the apparently prosperous Eurozone with counterfeit documents or refugees turning out to be uninvited migrants or not even some unwarranted claim educating “true Britons” about the “Great European Robbery of sovereignty, economy, and opportunities”.

“BRITAIN MAKES THE MOST OUT OF EU” – DELUSION OVERLOADED

From David Cameron to the Wall Street Journal to Xi Jinping, the outright claim is, UK’s average cost of £190m is clearly outweighed by what it receives. Some aggressive ones might extend further and outrage over Nigel Farage’s magical £350m figure and debate about the feasibility of diverting it completely to the NHS.

For EU and rest of the world, the Britain does not use the Euro, does not take as much migrants as much as other do, does not comply with most of the common security defense policy regulations.

These claims are indisputable. Given, the number are perfect.

THE NUMBER DELUSION

The numbers won’t show UK’s compensation for an East European – Xenophobic nation’s reluctance to allocate funds to deal with refugee screening in Greece and Italy.(Over £5bn)

They won’t tell you the numbers you spent on mainland european security due to refugee influx, even after the UK had tripled its budget for operation FRONTEX. (Over £20bn)

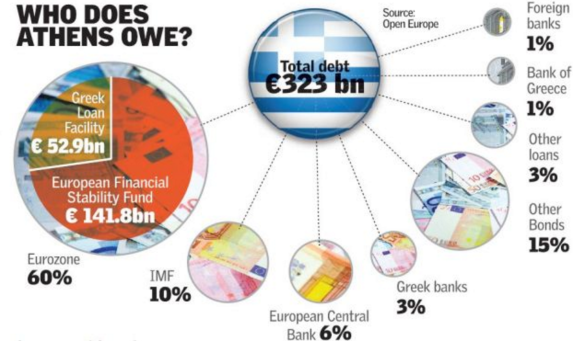

They won’t include the extra £500/household allocated for Greek bailout funds. This is actually a 2012 figure and it has quadrupled over the years.

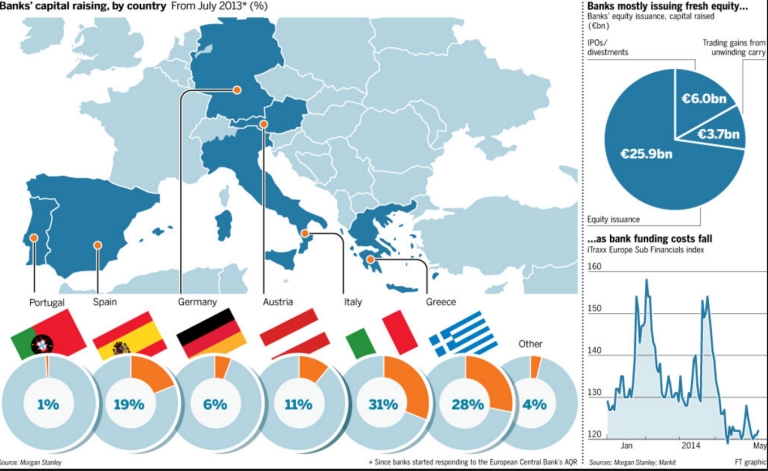

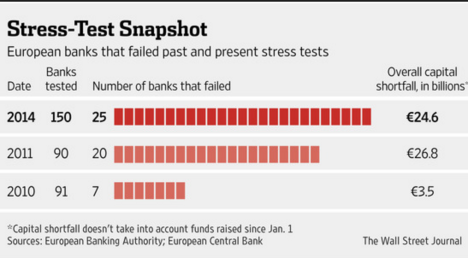

They won’t account for all that UK had to pour in to rescue failed European banks.

The average IMF, OECD or a leftist journal study simply consists of a clear comparison of just membership costs vs membership benefits. With the changing character of EU and it’s priorities, stronger ones paying for the mess that weaker ones made is now a routine.

There’s actually more for the EU to load on the UK. After the referendum (if UK stays), the UK has an immediate £26bn mainland financial stability payment and long list of other taxes and funds worth billions as rescue packages. These deadlines have been muted for a while as the EU lobbies to stop a Brexit.

They won’t tell you this because these are exceptional costs.

They won’t have to tell you that exceptions are Europe’s current reality. You know it.

“SACRIFICES IN HARD TIMES WILL PAY OFF IN GOODTIMES” DELUSION

What are good times?

Have seen any recently, at least the past 8 years?

Nope.

UK’s sacrifices were paid of by an aggregate 1% negative growth, fuelled by Irish, Spanish, Portuguese and Greek financial crisis and highly leveraged German banks.

UK, though not as much as Germany, has thrown over £126bn for Eurozone banking recovery system, in which the UK does not even know who exactly gets a pie of the british bailout fund. Any attempt to chase down the flow of your own money around the humongous institutions in Brussels will prove failure.

This scenario paves way, for the next most argued case, – lack of transparency and accountability.

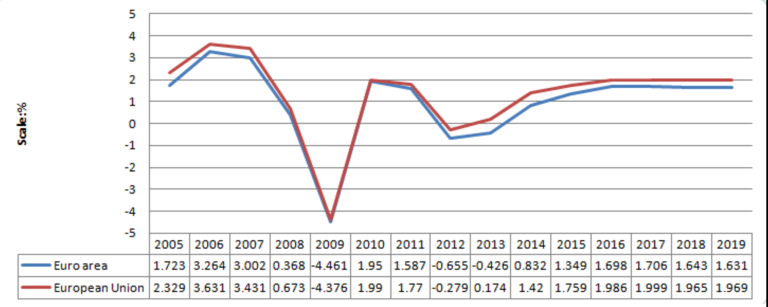

GDP GROWTH 2005- 2019 Source – EUROSTAT

This note will further extend to prove that Goodtimes can never come as the BreakUp time is closer.

The love for integrating with European partners has much deluded the hard reality of devastating state of eurozone economy.

PAYING SOMEONE ELSE’S BILLS AFTER INTEGRATION – HARD REALITY

TARGETS TO BE MET RIGHT AFTER THE REFERENDUM, if UK decided to stay

- The long muted £260billion migrant allocation targets need to be met

- €700 million for the emergency support mechanism, linked to the migrant crisis.

- €2 billion more per year for the EU’s ‘Flexibility Instrument’.

- €1 billion more per year for the Emergency Aid Reserve.

- €7.6 billion to European Financial Stability Mechanism to fund Greece.

- A proposed increase in regular membership fees.

AN INTRODUCTION TO THE BROKEN SYSTEM – THE INTEGRATION DELUSION

The most politically incorrect statement of the hour would be to call “integration” a failure, especially in Europe where unaccountable policy makers are heading towards both an intensive and an expansive European integration spree by 2020.

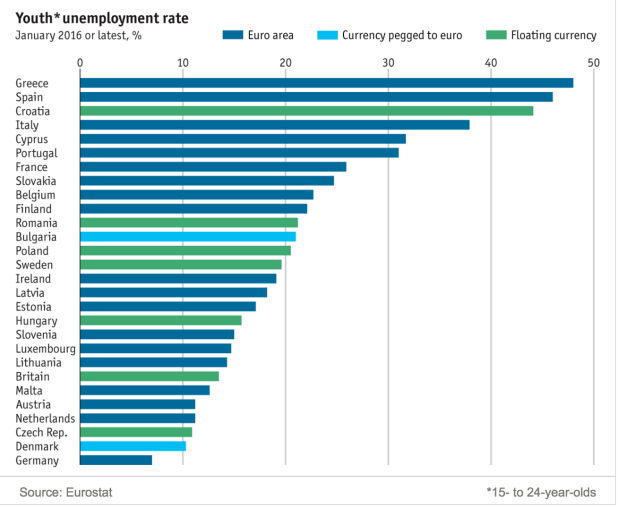

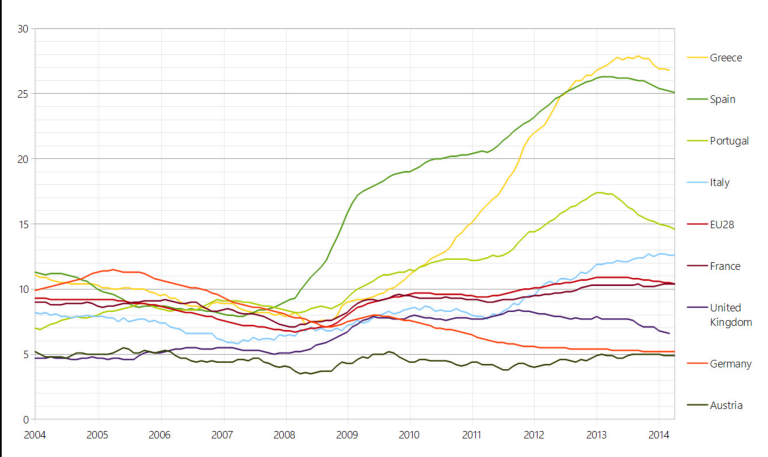

Undeniably, economic integration since 1973 has made miracles happen. This does not imply that a model of a prosperous 5 country union must be extended to 28 countries, where participation in anti-austerity protests is all that the unemployed youth have.

This argument takes the cornerstone to this entire note.

‘EUROZONE CRISIS – AN AFTERSHOCK OF 2008’ DELUSION

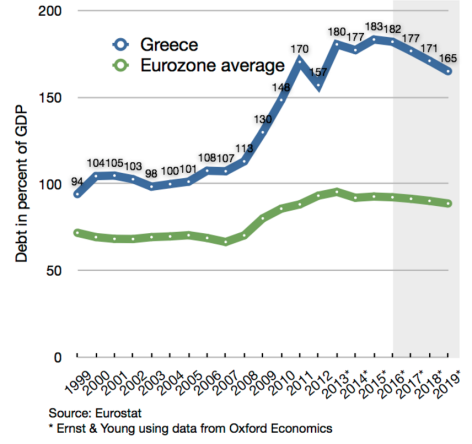

The most deluded of all, europhiles propagate that EU is on its way to a sustainable 2008 recovery and this is bullocks. The european crisis had begun ever since Goldman Sachs managed to complete its credit default swaps in 2000-2001 to push Greece into the union. This powered global investors to buy unproductive east european junk after the South-East Asian misadventure. The simple idea that Greeks, Portuguese and Spanish shared the same currency with the Germans and French, had encouraged a ruthless cheap credit spree that only sufficed unrealistic campaign promises by corrupt politicians.

Even this data (above) might prompt someone to assume that Greece was better off, pre-2008.

Here’s the big mistake. Until the 2010 Greek government expose, no one, even the ECB was clueless about the level of public debt accumulated in the EU (This is a key flaw in this integrated system, which will be dealt with later). This means the true levels of debt from 2001-2010 is unknown. Rationality can explain that only a crisis that started 15 years ago, can still remain untamable despite so much austerity.

“MONETARY- FISCAL” DELUSION

Previously, this note threw some light on the cheap credit spree to unproductive entities.

This style of lending at the first case is a root cause of an arbitrary central bank that attempts to bind all euro economies on the same monetary policy because of the common currency.

The issue lies in the fact that an absolute lack of oversight on the fiscal policy of individual nations leaves the ECB clueless about the right monetary policy to blend with each nation’s fiscal policy. In some sense, it is arguable that total lack of oversight of the unplayable debt accumulation in Greece has magnified the crisis.

PROSPERITY DELUSION

It’s been a long while since the words EU and prosperity have sounded synonymous.

As stated earlier, tying up economies around the same level is justifiable, but not when economies with unemployment rates ranging from 3% to 30% are tied up.

This does not result in economic growth for all, this only results in economic aid and rescue for the weak.

Seriously?

Who calls EU a prosperous union when, most banks are underc- apitalised, public debt is exceeding 200% of GDP, investment is eroding, cultural diversity and self-interested patriotic realists who never land at a common ground, perfectly dysfunctional border system, commodity crisis is hitting EU worse than OPECs, major tourism is soaring and even the dollar is taking over the euro.

By 2016, 13 austerity programmes have failed, proving the incompetency of these states and the entire union is at the brink of it’s collapse.

Most of these funds have been sent to these failed economies through various EU bodies, but the UK is one of the top 3 contributor to save nations that it has no connection or benefit with.

“CAMERON -INTEGRATION MEANS RISK FREE” – DELUSION

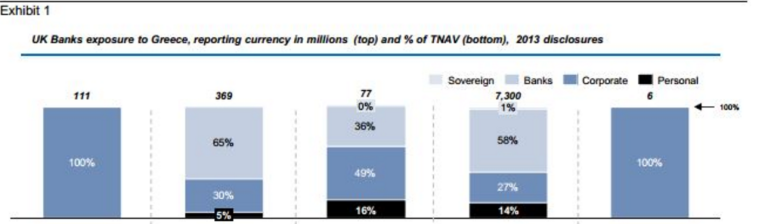

The degree of economic risk held by British institutions as a result of integration can be assessed through a careful examination of the banking and financial services industry, an industry that most europhiles claim to be the backbone of UK and would die soon after Brexit.

STRESS TEST – HARD REALITY

The recent stress test carried out by the ECB only shows that despite imposition of stricter risk-weighted asset -tier 1 capital ratios, banks defaults and capital inadequacy ratios have risen.

But results look more like

French and German banks holding Greek junk with leverage ratios around 33:1 , worse than Lehman, Bear and Northern Rock’s ratio before filing for bankruptcy.

Europhiles say, UK’s financial services will soar without European connection.

What sort of connection?

Holding European systematic risk in British books?

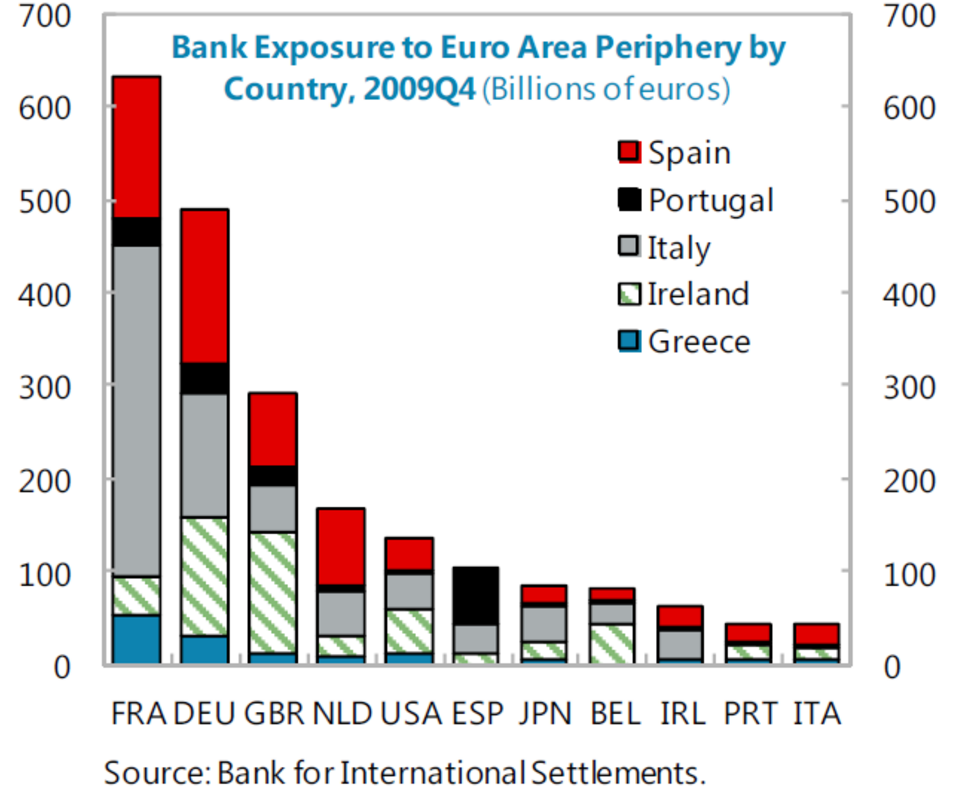

To put the degree of exposure in perspective,

First let’s take a look at some uncommon statistics on European Debt Crisis exposure,

The bottom line, lies in this point that economic integration will not just suck up UK’s pockets to pay others’ bills but it will also signficantly expose UK to the failure of Euro, which is bound to happen in the current state as Greece has defaulted on all its bailouts.

Economic disintegration is one of the possible solutions to minimise the aftershocks of a Euro failure.

This argument is centred around the fear that it is imperative to take decisions just not with what we see today, but also with regard to the plight of this union, where predicting the future for a well-informed decision is unpredictable.